Mutual Fund Schemes

Bajaj Finserv Consumption Fund

Equity Fund Regular GrowthBajaj Finserv Flexi Cap Fund

Equity Fund Regular GrowthBajaj Finserv Large Cap Fund

Equity Fund Regular GrowthBajaj Finserv Large and Mid Cap Fund

Equity Fund Regular GrowthBajaj Finserv Multi Asset Allocation Fund

Hybrid Fund Regular GrowthBajaj Finserv Balanced Advantage Fund

Hybrid Fund Regular GrowthBajaj Finserv Arbitrage Fund

Equity Fund Regular GrowthBajaj Finserv Banking and PSU Fund

Debt Fund Regular GrowthBajaj Finserv Money Market Fund

Debt Fund Regular GrowthBajaj Finserv Overnight Fund

Debt Fund Regular GrowthBajaj Finserv Liquid Fund

Debt Fund Regular GrowthWhat are mutual funds?

- A mutual fund is a collective investment instrument, which gathers a pooled amount of money from multiple investors. This collected sum is invested in different financial instruments like stocks, commodities, bonds, and other securities. Mutual funds are managed by professional fund managers, who come with years of experience in managing investment portfolios. This gives you, the investor, access to professionally managed portfolios without having to learn about market analysis and investment strategies. With easier access to debt and equity markets at lower transaction costs, investors can also reap the benefits of diversification and liquidity with mutual funds.

Types of mutual funds

Mutual funds can be categorised based on the type of asset class they invest in. Under this classification, there are five main types of mutual funds:

Equity mutual funds: These funds primarily invest in stocks and can be suitable for new investors who wish to invest in the stock market but lack the expertise or time to research individual stocks.

Debt mutual funds: These funds primarily invest in fixed-income securities such as bonds and can be suitable for investors who wish to have a relatively steady returns and less risk to capital as compared with equity mutual funds.

Hybrid mutual funds: These funds invest in a mix of equity and debt securities and are suitable for investors who want a balanced portfolio of stocks and bonds. The equity component can deliver potential capital appreciation, while the debt component can generate a steady income.

Solution oriented: Solution oriented mutual fund can help investors achieve their specific financial objective. These funds can also help investors build corpus for life events such as retirement, child education, marriage. Securities Exchange Board of India (SEBI) has specified two solution-oriented funds that AMCs can offer: retirement fund and children’s fund. As their names suggest, they are meant to serve specific purposes and hence provide ‘solution’ to specific requirements.

Other mutual funds: These funds include sectoral funds, thematic funds, international funds, and commodity funds. For instance, sectoral funds invest in specific sectors, such as technology, healthcare, or energy; international funds invest in overseas markets, while commodity funds invest in commodities.

How does mutual fund work?

Mutual funds work by pooling money from multiple investors with a common investment objective and investing it in a diversified portfolio of securities such as stocks, bonds, money market instruments, and other assets. The pooled funds are managed by professional fund managers who make investment decisions based on the fund's objective and strategy.

When an investor invests in a mutual fund, they purchase units of the fund, which represent their share in the total assets of the fund. The value of these units is calculated based on the fund's net asset value (NAV). The NAV in mutual fund is the total value of the fund's assets minus its liabilities, divided by the total number of units outstanding.

Learn About Mutual Funds

Value investing and momentum…

Behavioral finance is a vital field…

Have you ever wondered how seasoned…

What is Systematic…

Investing in mutual funds is an easy…

Of the almost 4 crore unique…

Traditional wisdom in the mutual…

Mutual fund schemes have always been…

A penny saved is a penny earned. And…

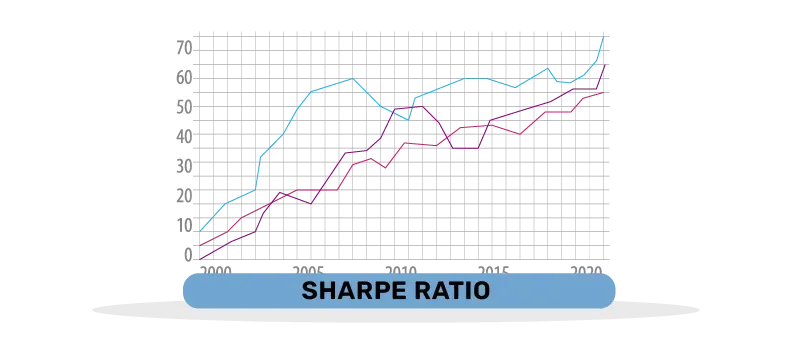

When investing and calculating…

The key to potentially growing your…

Investing in mutual funds can be a…

When we think of financial…

The life you lead today, would it be…

Frequently Asked Questions

Mutual funds can be considered a relatively stable investment option than stocks. However, the value of mutual fund investments can fluctuate based on market conditions, and there is no guarantee that investors will earn a profit. It is always advisable to seek the help of a financial expert before making any investment decision.

Most mutual fund schemes that do not come with a lock-in period can be redeemed at any time. It's important to read the terms and conditions of a mutual fund scheme carefully before investing to understand any restrictions on redemption.

Open-end mutual funds continuously issue new units to investors and redeems units from investors who wish to sell, whereas closed-end mutual funds issue a fixed number of units that trade on a stock exchange. This means that open-end funds can fluctuate in size as more units are issued or redeemed, while closed-end funds remain a fixed size.

Videos About Mutual Funds

Presenting 'The Third Source', our…

Presenting 'The Third Source', our…

Presenting 'The Third Source', our…