Explore Our Mutual Fund Schemes

Dream Car Calculator: Overview

Owning a car is an aspiration for many. However, as with all major expenses, it needs planning. Whether you’re paying upfront or taking a loan, it’s important to know exactly how much you need to save or invest to buy the car you have your eye on.

It can be challenging, however, to plan for such an event, especially if it’s a few years away.

A dream car calculator can be your financial roadmap. It shows you how close you are to turning that dream into reality and how you can get closer to your goal in an effective and timely way. With just a few inputs, the car planning calculator can turn a distant ambition into a concrete plan, potentially making the journey towards owning your dream car smoother.

What is a dream car calculator?

A dream car calculator online is a financial tool designed to help you estimate how much money you need to save to purchase your dream car. Based on a few simple inputs such as the car's current price, your existing savings and the number of years after which you wish to buy the car, the dream car planner tells you in seconds how close you are to your goal, and how much more you need to save to potentially get there.

Whether you're planning to buy a sleek sports car, a luxury sedan, or an eco-friendly electric vehicle, a calculator for dream car helps you break down your goal into manageable steps. It also helps you identify if your goals are achievable or if you need to alter your investment amount, timeline, or vehicle type.

How a dream car calculator works

The Dream Car Calculator is an easy-to-use tool that gives you instant estimates based on just a few inputs. All you need to do is enter some details. Different tools may require different inputs, but these would typically include:

- Number of years until you buy the car

- Cost of the car

- Expected inflation rate

Based on this, the tool will apply its dream car calculator formula (each tool may have different formulae depending on the inputs and outputs). You can then use this car planning calculation to develop your roadmap.

How to use Bajaj Finserv AMC Car Calculator

To use this calculator, you need to enter the following details:

- Number of years until you buy the car

- Present cost of the car

- Amount you have saved for the car (if any)

- Expected rate of return

- Assumed inflation rate

Based on this, the calculator will tell you the following:

- Future value of the car (adjusted for inflation)

- Future value of your current and planned investments

- How close you will be (in percentage) to your goal if you follow your current plan. It could be 10%, 50%, 80% etc.

- Monthly SIP or lumpsum required to potentially reach your goal

How does a car calculator help in planning for your dream car?

A car calculator breaks down the financial steps needed to achieve your goal. It calculates how much you need to invest to potentially reach your goal based on the car’s price and your current savings, if any. It also factors in inflation to help you assess the true value of the car at the time of purchase. Accordingly, it helps you set realistic goals as you can assess if it is feasible for you to buy the vehicle that you have your eye on in your planned timeframe. You can also adjust the different amounts to arrive at a suitable combination.

Benefits of choosing SIP for your dream car

With an SIP, you invest a fixed amount regularly into mutual funds, allowing your money to grow over time through compounding.

SIP promotes disciplined investing by automating monthly contributions, making it easier to stay consistent.

SIPs reduce the impact of market volatility by spreading your investments over time. As a result, SIPs can leverage market ups and downs.

Learn About Mutual Funds

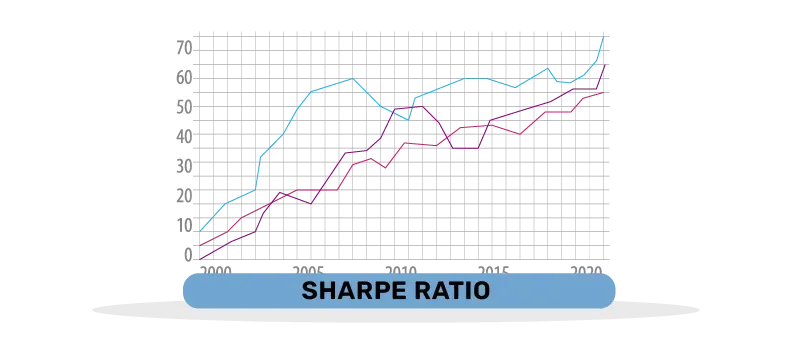

Value investing and momentum…

Behavioral finance is a vital field…

Have you ever wondered how seasoned…

What is Systematic…

Investing in mutual funds is an easy…

Of the almost 4 crore unique…

Traditional wisdom in the mutual…

Mutual fund schemes have always been…

A penny saved is a penny earned. And…

When investing and calculating…

The key to potentially growing your…

Investing in mutual funds can be a…

When we think of financial…

The life you lead today, would it be…

Related Videos

Frequently Asked Questions

The investment avenue that is suitable for you depends on many factors, such as your finances. SIPs allow you to invest in consistent, manageable instalments and can spread market risk over time. Lumpsum investments may work if you have a large amount upfront and can handle slightly higher volatility risk.

You would need to determine the car’s cost, your timeline. current savings and expected investment returns. Then, you would need to account for inflation and the potential compounding effect on your savings or investments. A calculator does this maths for you and gives you instant estimates.

Inflation reduces the purchasing power of money over time, meaning the value of your savings might not grow enough to meet your goal unless your investments offer returns that outpace inflation.

Mutual funds offer diversification, professional management, and higher return potential compared to traditional avenues, particularly if they are equity oriented. They can help grow your wealth over time to bring you closer to your goal.

Yes, most types of mutual funds offer liquidity, allowing you to withdraw money before reaching your goal. However, early withdrawals may affect your long-term investment plan and growth potential.

Look for funds with a strong management team and investment strategy. Also make sure that the scheme’s risk level aligns with your investment horizon and risk appetite. Consider consulting with a financial advisor to match the fund with your goal and risk tolerance.

Disclaimer: The calculator alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. This tool is created to explain basic financial /investment related concepts to investors. The tool is created for helping the investor take an informed decision and is not an investment process in itself. Mutual Fund does not provide guaranteed returns. Investors are advised to seek professional advice from financial, tax and legal advisor before investing.