List of Equity Mutual Fund Schemes

Bajaj Finserv Consumption Fund

Equity Fund Regular GrowthBajaj Finserv Flexi Cap Fund

Equity Fund Regular GrowthBajaj Finserv Large Cap Fund

Equity Fund Regular GrowthBajaj Finserv Large and Mid Cap Fund

Equity Fund Regular GrowthEquity funds: Exploring growth opportunities

How do equity funds work?

Equity funds pool money from multiple investors and invest in a diversified portfolio of stocks. The fund manager selects stocks based on various factors such as company fundamentals, industry outlook, and market trends. The goal is to achieve capital growth by investing in companies with strong growth potential or undervalued stocks that have the potential to appreciate in value over time.Unlike debt funds, where returns are primarily generated through interest income, equity funds derive their returns from capital gains – the difference between the purchase price and the selling price of the stocks held in the portfolio. These funds may also distribute dividends to investors, which are a portion of the profits earned by the underlying companies.

Who should invest in equity funds?

Equity funds are suitable for investors with a longer investment horizon and a higher risk tolerance. They can be suitable for individuals seeking to build wealth over time, such as young professionals, retirement savers, and those with long-term financial goals. While equity funds offer the potential for higher returns compared to debt funds, they also come with higher volatility and a higher risk of capital loss.Investors looking to diversify their investment portfolio and make use of the growth potential of the stock market may consider allocating a portion of their assets to equity funds. However, it's essential to align investment decisions with personal financial goals, risk tolerance, and time horizon.

Things to consider before choosing an equity fund

Before investing in an equity fund, investors should conduct thorough research and consider the following factors:Investment objective: Determine whether the fund's investment objective aligns with your financial goals, whether it's capital appreciation, dividend income, or a combination of both.

Risk profile: Assess your risk tolerance and investment horizon to choose an equity fund that matches your risk-return preferences.

Fund performance: Evaluate the historical performance of the fund, considering both short-term and long-term returns relative to its benchmark and peer group.

Fund manager expertise: Research the track record and experience of the fund manager in managing equity portfolios and their investment strategy.

Diversification: Consider the diversification benefits offered by the fund's portfolio across different sectors, industries, and market capitalizations.

Learn About Mutual Funds

Value investing and momentum…

Behavioral finance is a vital field…

Have you ever wondered how seasoned…

What is Systematic…

Investing in mutual funds is an easy…

Of the almost 4 crore unique…

Traditional wisdom in the mutual…

Mutual fund schemes have always been…

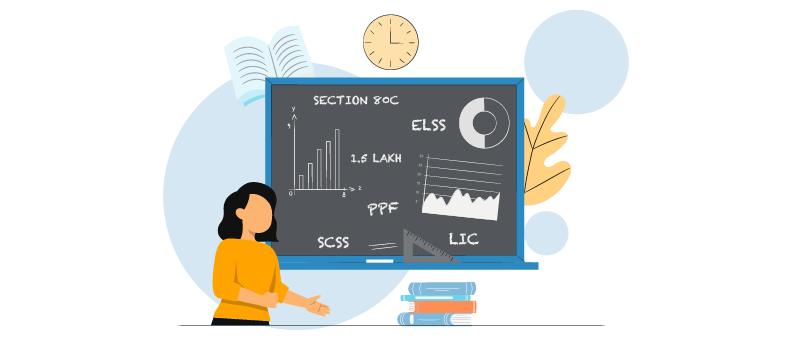

A penny saved is a penny earned. And…

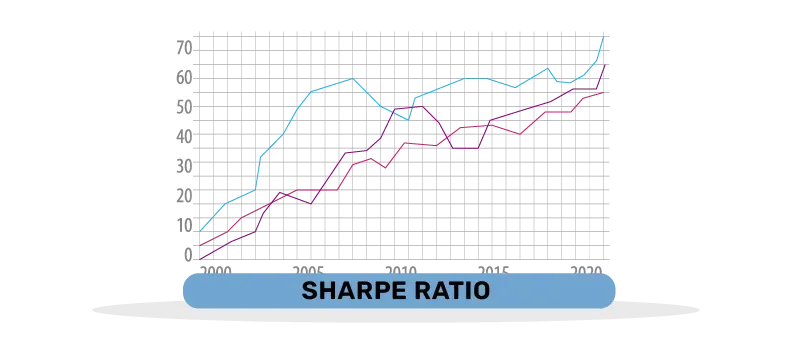

When investing and calculating…

The key to potentially growing your…

Investing in mutual funds can be a…

When we think of financial…

The life you lead today, would it be…

Frequently Asked Questions

An equity fund is a type of mutual fund that primarily invests in stocks or equities. These funds aim to achieve capital appreciation by investing in companies with growth potential or undervalued stocks.

Yes, equity funds carry a higher level of risk compared to debt funds due to the volatility of the stock market. They are subject to market fluctuations, economic conditions, and company-specific risks.

When selecting an equity fund, consider your investment goals, risk tolerance, and time horizon. Look for funds with a consistent track record of performance, experienced fund managers, and a well-diversified portfolio aligned with your investment objectives. Conduct thorough research and seek professional advice if needed.

Mutual Fund Videos: Watch, Learn, Invest

Megatrends investing means looking…

Megatrends help anticipate the…

Megatrends investing focuses on long…